CARES HEERF Ledger Posting

Creation date: 9/24/2020 7:18 AM

Updated: 10/1/2021 8:42 AM

The government has responded to COVID-19 by providing schools federal funds to disburse to the students in order to cover food, rent, utilities, etc. via the means of the Coronavirus Aid, Relief, and Economic Security Act (CARES).

As the schools receives these funds, proper documentation in SMART is crucial. These funds should not be reflected in either Box 1 or Box 5 on the 1098T.

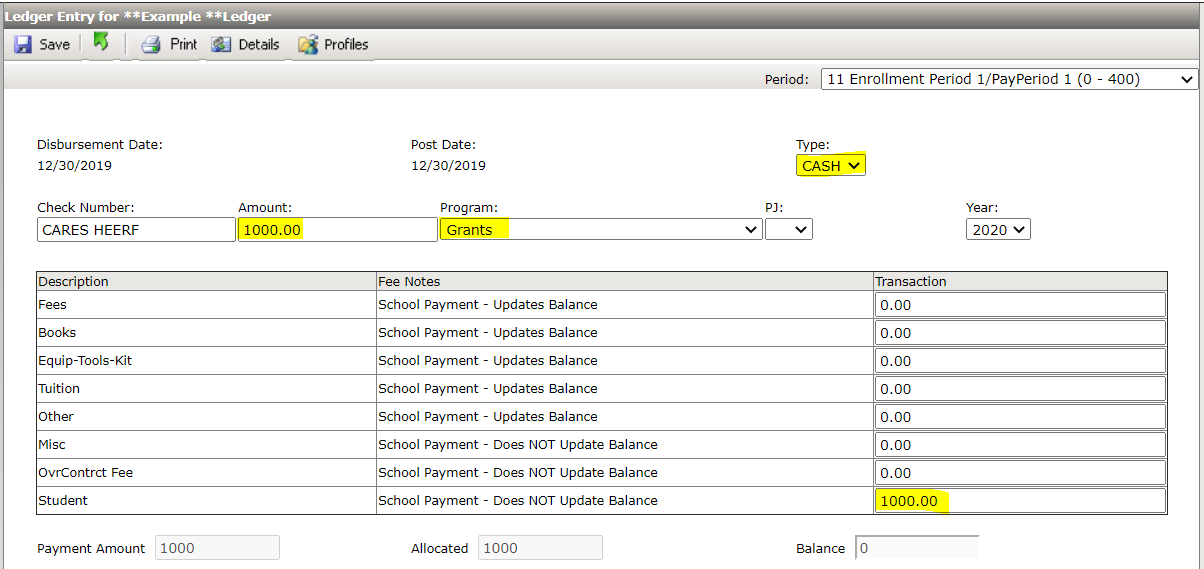

Documenting this in SMART can be done by making a CASH entry towards the Student criteria. Make sure to also use the general Grants program as that would have it reflect properly as a Federal Grant. Additionally, it would help to put this is CARES, HEERF, or a combination of such in the Check Number field. This can have further assistance down the road.

This would make it reflect properly on the 1098T.

As the schools receives these funds, proper documentation in SMART is crucial. These funds should not be reflected in either Box 1 or Box 5 on the 1098T.

Documenting this in SMART can be done by making a CASH entry towards the Student criteria. Make sure to also use the general Grants program as that would have it reflect properly as a Federal Grant. Additionally, it would help to put this is CARES, HEERF, or a combination of such in the Check Number field. This can have further assistance down the road.

This would make it reflect properly on the 1098T.