1098-T Electronic Filing

Creation date: 1/3/2019 10:21 AM

Updated: 1/16/2024 10:02 AM

https://youtu.be/C7E9cAzwX9Q

Generating the File

SMART recommends allowing time for your students to review the paper copies of their 1098-T prior to filing electronically. This allows for any needed corrections before submitting it to the IRS.

On the OnlineSMART sidebar go to Administration > 1098-T Electronic Filing.*

Submitting the File

The generated file is formatted to meet IRS requirements. You shouldn't attempt to open it, as any changes may cause it to be rejected by the IRS.

Submit this unopened file to: IRS FIRE Site.

Troubleshooting

Upload Error

If you experience an error when uploading the file, we may be able to help. If the error is not specific, log into your IRS login at the FIRE site and open the error message there to see the details. Email the detailed error message to Support@OnlineSMART.Net and we will investigate the error and notify you.

Browser

Internet Explorer 6.0 or lower may have problems connecting to the FIRE System. Use a more up-to-date browser to transmit your 1098-T.

Corrections

If you do need to file a correction after electronically filing, you should first make the needed updates or changes. Then generate the electronic file once again and email it to Support@OnlineSMART.Net. We will make the necessary adjustments and return the file to you for re-submission.

*If you don’t see the option available, check with your Administrator for the User Rights necessary to access it.

Generating the File

SMART recommends allowing time for your students to review the paper copies of their 1098-T prior to filing electronically. This allows for any needed corrections before submitting it to the IRS.

On the OnlineSMART sidebar go to Administration > 1098-T Electronic Filing.*

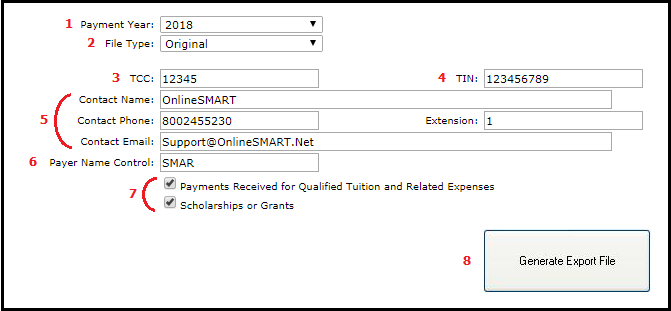

- Payment Year - Use the drop down box to update to the year you’re filing for, not the current year.

- File Type - Leave this set to Original.

- TCC - The Transmitter Control Code is assigned to you by the IRS. Your CPA may file under their own TCC, check with them.

- TIN - This is your Tax Identification Number (also known as Federal Employment Identification Number).

- Contact Name/Phone/Email - This should be the name the 1098-T will be filed under, typically the school owner or school's name. Phone, Extension and Email should be for the school or primary point of contact.

- Payer Name Control - This will be the first four letters of the name of the business you file under.

- The last 2 check boxes should be left at their default, in order to ensure your 1098-T generates correctly.

- Generate Export File - Once all the information is complete, click this button to build your 1098-T file and download it to your PC.

Submitting the File

The generated file is formatted to meet IRS requirements. You shouldn't attempt to open it, as any changes may cause it to be rejected by the IRS.

Submit this unopened file to: IRS FIRE Site.

Troubleshooting

Upload Error

If you experience an error when uploading the file, we may be able to help. If the error is not specific, log into your IRS login at the FIRE site and open the error message there to see the details. Email the detailed error message to Support@OnlineSMART.Net and we will investigate the error and notify you.

Browser

Internet Explorer 6.0 or lower may have problems connecting to the FIRE System. Use a more up-to-date browser to transmit your 1098-T.

Corrections

If you do need to file a correction after electronically filing, you should first make the needed updates or changes. Then generate the electronic file once again and email it to Support@OnlineSMART.Net. We will make the necessary adjustments and return the file to you for re-submission.

*If you don’t see the option available, check with your Administrator for the User Rights necessary to access it.